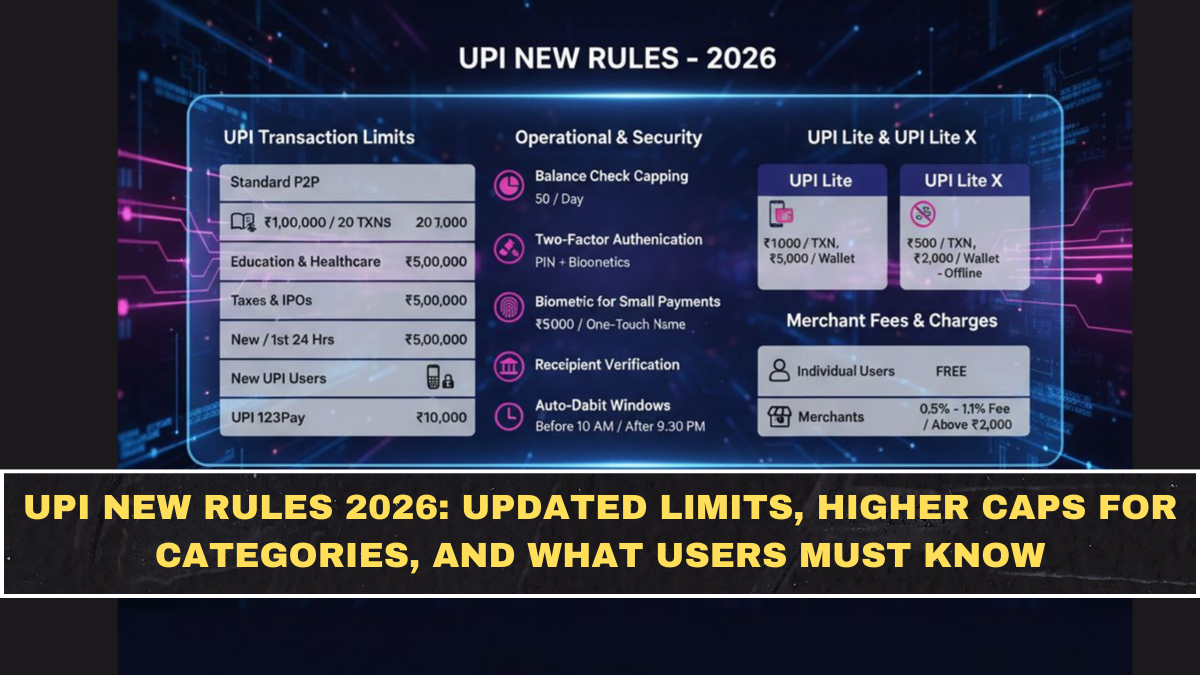

Digital payments have transformed everyday financial transactions, and Unified Payments Interface continues to dominate India’s payment ecosystem. The UPI new rules 2026 introduce updated transaction limits, category-based caps, and revised usage conditions that affect how individuals and businesses use digital payments.

While UPI remains convenient and fast, many users are unaware of transaction caps, bank-specific restrictions, and category-based limits that influence payment success. Understanding these updated rules helps users avoid failed transactions, manage payment limits effectively, and maintain secure digital payment habits.

The updated framework focuses on improving transaction efficiency, security, and financial control.

Why UPI Rule Updates Matter in 2026

As digital payment volume increases, regulators and financial institutions regularly update operational rules to ensure system stability and fraud prevention. The UPI new rules 2026 affect daily payment limits, category-specific transactions, and compliance measures.

These updates help users:

-

Understand transaction limits clearly

-

Avoid payment failures

-

Improve digital payment security

-

Plan high-value transactions better

-

Use UPI efficiently for different payment types

Awareness improves payment reliability.

Standard Daily UPI Transaction Limits

UPI transactions are subject to daily caps to maintain security and control transaction flow.

Key limit features include:

-

Daily transaction cap for most users

-

Per-transaction limit restrictions

-

Bank-specific variations in limits

-

Limit reset after defined period

Users should check bank-specific limits for accuracy.

Category-Based Higher Transaction Limits

Certain transaction categories may allow higher limits compared to regular payments.

Common categories with higher limits include:

-

Healthcare payments

-

Education fee transactions

-

Government payments

-

Investment or financial transactions

Category-based limits enable large essential payments.

Bank-Specific UPI Limits

UPI operates through multiple banks, and each bank may set different transaction caps.

Important factors include:

-

Bank-specific daily limits

-

Per-transaction restrictions

-

Account type influence on limits

-

Customer risk profile considerations

Understanding bank policies prevents transaction delays.

What Happens When You Hit UPI Limits

Exceeding transaction limits may cause payment failure or temporary restrictions.

Possible outcomes include:

-

Transaction rejection

-

Temporary payment restriction

-

Need to wait for limit reset

-

Alternative payment requirement

Planning payments avoids disruptions.

UPI Transaction Frequency Restrictions

Apart from monetary limits, some systems also restrict the number of transactions within a specific time period.

Frequency control helps:

-

Prevent system overload

-

Reduce fraudulent activity

-

Maintain transaction stability

Users should avoid repeated rapid transactions.

UPI Limits for Merchant Payments vs Personal Transfers

Different limits may apply depending on transaction type.

Key distinctions include:

-

Personal transfers between individuals

-

Merchant or business payments

-

Online purchases

-

Subscription or automated payments

Transaction purpose may affect limits.

Security Enhancements in UPI Rules

Security improvements aim to protect users from fraud and unauthorized access.

Security measures include:

-

Stronger transaction authentication

-

Risk-based transaction monitoring

-

Enhanced fraud detection mechanisms

-

Improved user verification processes

Security upgrades improve trust in digital payments.

UPI Usage for High-Value Transactions

Users often rely on UPI for large payments such as fees or purchases. Understanding limits ensures smooth processing.

Best practices include:

-

Checking transaction limits beforehand

-

Splitting large payments if required

-

Using category-based higher limits

-

Using alternative payment methods when needed

Preparation prevents transaction failure.

Common Reasons for UPI Transaction Failure

Understanding failure reasons helps users resolve issues quickly.

Typical causes include:

-

Exceeding daily limit

-

Insufficient bank balance

-

Bank server issues

-

Incorrect UPI ID

-

Security restrictions

Identifying cause improves payment experience.

How to Check Your UPI Limit

Users can verify limits through banking platforms or payment applications.

Checking methods include:

-

Reviewing bank mobile app settings

-

Checking payment app guidelines

-

Contacting bank support

-

Reviewing account terms

Awareness prevents confusion.

How UPI Rules Improve Digital Payment Ecosystem

Regulatory updates aim to maintain system efficiency and user confidence.

Key improvements include:

-

Better transaction reliability

-

Improved fraud prevention

-

Controlled transaction flow

-

Enhanced user protection

Updated rules support long-term system stability.

Best Practices for Smooth UPI Usage

Following structured practices ensures efficient digital payments.

Recommended habits include:

-

Monitoring daily transaction usage

-

Verifying payment details before transfer

-

Avoiding repeated failed attempts

-

Keeping payment app updated

-

Using secure devices for transactions

Responsible usage improves experience.

Impact of UPI Rules on Digital Payment Adoption

Updated rules influence how individuals and businesses use digital payment systems.

Impact includes:

-

Greater transaction transparency

-

Improved security confidence

-

Higher adoption of digital payments

-

Efficient financial transactions

Strong regulations support digital growth.

Conclusion

The UPI new rules 2026 provide updated transaction limits, category-based higher caps, and enhanced security measures that improve digital payment reliability. Understanding transaction limits, bank-specific rules, and security features helps users avoid payment failures and use UPI efficiently.

Digital payments continue to evolve with changing financial needs. By staying informed about updated rules and adopting responsible payment practices, users can benefit from faster, safer, and more efficient financial transactions.

FAQs

What are UPI new rules 2026?

They include updated transaction limits, category-based higher caps, and enhanced security measures.

Is there a daily UPI transaction limit?

Yes. Most users have a daily limit, which varies by bank.

Can UPI be used for high-value payments?

Yes, certain categories allow higher transaction limits.

Why do UPI transactions fail sometimes?

Common reasons include exceeding limits, insufficient balance, or technical issues.

Do all banks have the same UPI limits?

No. Transaction limits may vary depending on the bank and account type.