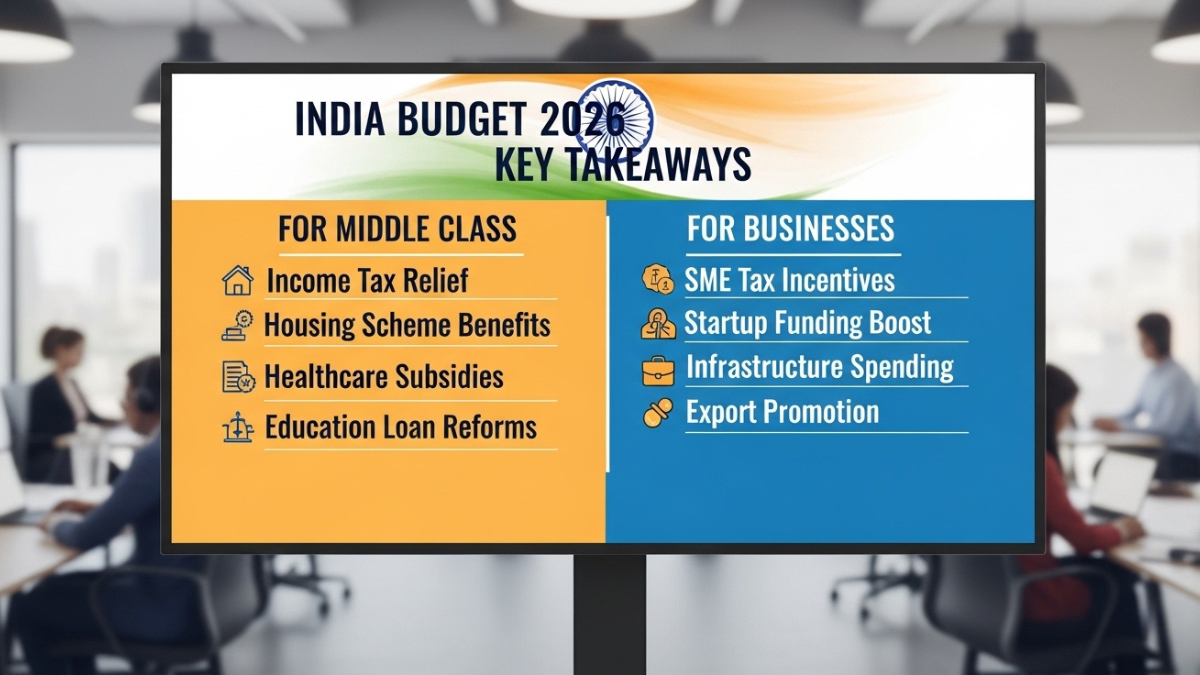

The Union Budget remains one of the most closely watched economic events in India, as it directly affects household finances, business confidence, and long-term growth priorities. The discussion around India budget 2026 key takeaways for middle class and businesses has intensified because this year’s budget arrives at a time of global uncertainty, domestic growth ambitions, and rising expectations from taxpayers. From salaried professionals to entrepreneurs, everyone is looking for clarity on how policy changes will impact daily life and future planning.

At its core, the budget reflects a balancing act between growth and fiscal discipline. The government has focused on strengthening the economy through an infra push, encouraging manufacturing, and refining policies around taxes, subsidies. For the middle class, the budget signals incremental relief and stability, while businesses are paying close attention to reforms that could improve competitiveness and job creation. Understanding these elements helps decode the real meaning of the India budget 2026 key takeaways for middle class and businesses.

What the Budget Means for the Middle Class

For the middle class, the India budget 2026 key takeaways for middle class and businesses revolve around cost of living, income stability, and savings. While there may not be dramatic changes, the budget emphasizes gradual relief through streamlined taxes, subsidies and targeted welfare measures. The focus is on maintaining purchasing power while ensuring long-term fiscal sustainability.

One notable aspect is the indirect impact of the infra push on employment and income stability. Infrastructure development often leads to job creation, which benefits households beyond direct tax changes. Additionally, support for manufacturing is expected to strengthen domestic supply chains, potentially reducing inflationary pressure on essential goods. For many families, these indirect benefits matter as much as immediate tax adjustments.

Business-Focused Measures and Manufacturing Growth

Businesses, especially small and medium enterprises, closely analyze the India budget 2026 key takeaways for middle class and businesses to understand how policy decisions affect operations and expansion plans. This year’s budget places strong emphasis on boosting manufacturing through incentives, improved logistics, and easier access to credit. These steps aim to position India as a competitive global production hub.

The continued infra push plays a crucial role in reducing operational costs for businesses. Better roads, ports, and digital infrastructure improve efficiency and encourage investment. Alongside this, rationalization of taxes, subsidies seeks to create a more predictable business environment. While challenges remain, the overall tone of the budget is growth-oriented, signaling long-term support for enterprise development.

Infrastructure Push and Job Creation

Infrastructure development stands out as a central theme in the India budget 2026 key takeaways for middle class and businesses. Large-scale investments in transport, energy, and urban development are designed to stimulate economic activity across sectors. This infra push not only strengthens physical assets but also generates employment opportunities at various skill levels.

Job creation linked to infrastructure projects has a multiplier effect on the economy. Increased demand for materials, services, and labor supports both formal and informal sectors. When combined with incentives for manufacturing, infrastructure investment helps create a cycle of growth that benefits businesses and households alike. The alignment of infra push with long-term development goals makes it a critical pillar of the 2026 budget.

Below is a simplified overview of how different segments are impacted:

| Focus Area | Key Budget Action | Expected Impact |

|---|---|---|

| Middle Class | Stable taxes and targeted subsidies | Improved financial security |

| Manufacturing | Incentives and policy support | Increased production and jobs |

| Infrastructure | Continued infra push | Economic growth and connectivity |

| Businesses | Predictable taxes, subsidies | Better planning and investment |

This table highlights how the India budget 2026 key takeaways for middle class and businesses are interconnected.

Taxes and Subsidies: What Changed and Why It Matters

Adjustments in taxes, subsidies are always closely scrutinized, as they directly affect disposable income and business margins. In 2026, the government appears to prioritize simplicity and efficiency over sweeping changes. The objective is to reduce compliance burdens while ensuring that subsidies reach intended beneficiaries.

For the middle class, rationalized taxes, subsidies can mean fewer complexities in financial planning. For businesses, clarity in tax structures supports long-term investment decisions. The budget’s approach reflects an effort to balance revenue generation with economic support, reinforcing the broader goals highlighted in the India budget 2026 key takeaways for middle class and businesses.

What Might Change Next: Looking Beyond 2026

While the current budget sets the tone, it also hints at future policy directions. The emphasis on manufacturing and infra push suggests continued focus on self-reliance and global competitiveness. Over time, this could lead to deeper reforms in labor laws, export incentives, and innovation support.

Future adjustments to taxes, subsidies may depend on economic performance and fiscal space. For now, the budget signals stability rather than disruption, giving both households and businesses time to adapt. Understanding these signals helps stakeholders prepare for what might change next beyond the immediate India budget 2026 key takeaways for middle class and businesses.

Conclusion: Reading the Budget Beyond Headlines

The India budget 2026 key takeaways for middle class and businesses reveal a clear strategy centered on growth, stability, and long-term development. While immediate benefits for individuals may appear modest, the broader focus on infra push, manufacturing, and balanced taxes, subsidies lays the foundation for sustainable economic progress. For businesses, the budget offers predictability and a supportive environment for expansion.

Ultimately, the true impact of the budget will unfold over time through job creation, improved infrastructure, and a stronger manufacturing base. By looking beyond headlines and understanding the interconnected elements, both middle-class households and businesses can make informed decisions and align their plans with the country’s economic direction.

FAQs

What are the India budget 2026 key takeaways for middle class and businesses?

They include stable tax policies, a strong infra push, and continued support for manufacturing growth.

How does the infra push benefit the middle class?

The infra push supports job creation and economic growth, indirectly improving income stability.

What does the budget say about manufacturing?

Manufacturing receives policy support and incentives to boost domestic production and employment.

Were there major changes in taxes and subsidies?

No major overhauls, but taxes, subsidies were streamlined for efficiency and clarity.

How should businesses respond to the 2026 budget?

Businesses can plan long-term investments by leveraging infrastructure development and manufacturing incentives.