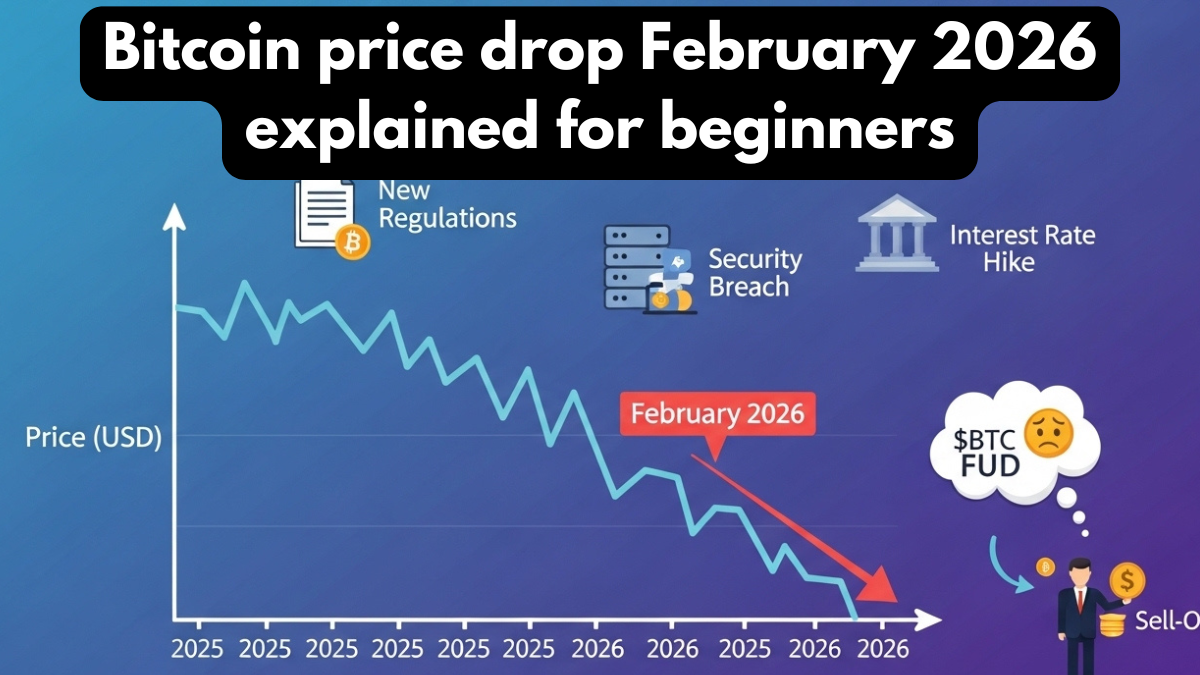

The recent volatility in the crypto market has left many investors searching for clarity, especially those new to digital assets. The topic Bitcoin price drop February 2026 explained for beginners has gained massive attention as sudden price movements triggered panic selling and confusion among retail traders. While experienced investors understand that market cycles are normal, beginners often struggle to interpret what a drop truly means. Understanding the underlying factors behind the decline is essential before making any decisions.

The current market correction highlights the importance of understanding support levels, risk management, DCA strategies rather than reacting emotionally. Instead of viewing every dip as a disaster, many long-term investors consider price drops part of a broader growth pattern. This article breaks down the reasons behind the decline, explains how beginners should approach it, and highlights the most common mistakes to avoid during uncertain market conditions.

Why Did Bitcoin Drop in February 2026?

One of the main reasons behind the Bitcoin price drop February 2026 explained for beginners is market sentiment combined with macroeconomic uncertainty. Changes in global interest rates, regulatory discussions, and investor expectations often influence crypto markets. When large investors adjust positions, price swings can become more intense, especially if key support levels are broken.

Another factor contributing to the drop is profit-taking after previous price rallies. Many traders who bought early choose to secure gains once the price reaches certain levels. This creates selling pressure that pushes the market downward. For beginners, understanding how support levels, risk management, DCA work together is essential for navigating such corrections without panic.

Understanding Support Levels and Market Psychology

In simple terms, support levels represent price zones where buying interest historically increases. When Bitcoin approaches these levels, traders watch closely to see whether the price will bounce or continue falling. The Bitcoin price drop February 2026 explained for beginners discussion often revolves around whether current support zones will hold or break.

Market psychology plays a major role in how investors react to price changes. Fear-driven selling can accelerate declines, while strategic buyers often enter at lower prices. Beginners should learn to analyze trends instead of reacting to short-term news. Practicing risk management helps prevent emotional decisions, and combining it with DCA strategies allows investors to average their purchase prices over time.

Below is a simplified overview of key concepts beginners should understand:

| Concept | Meaning | Why It Matters |

|---|---|---|

| Support Levels | Price zones with buying interest | Helps identify potential rebounds |

| Risk Management | Controlling investment exposure | Reduces losses during volatility |

| DCA | Investing small amounts regularly | Minimizes timing risk |

| Market Sentiment | Investor emotions and expectations | Drives short-term price movement |

This table explains why support levels, risk management, DCA are frequently mentioned when discussing the Bitcoin price drop February 2026 explained for beginners.

What Beginners Should Do During a Price Drop

When markets fall, beginners often feel pressure to act quickly, but patience is usually more effective. One of the most important lessons from the Bitcoin price drop February 2026 explained for beginners discussion is to avoid making impulsive decisions based solely on fear. Instead, investors should focus on long-term strategies and evaluate whether their original investment goals remain valid.

Using DCA is a common approach during volatile periods because it spreads purchases over time rather than relying on perfect market timing. At the same time, proper risk management ensures that investors do not allocate more funds than they can afford to lose. Monitoring support levels can also help beginners understand whether the market is stabilizing or continuing downward.

What Beginners Should Avoid Right Now

While learning from the Bitcoin price drop February 2026 explained for beginners, it is equally important to know what not to do. One common mistake is panic selling during short-term declines. Many investors sell at a loss only to watch prices recover later. Another mistake is overinvesting in an attempt to “buy the dip” without a clear strategy.

Ignoring risk management principles can lead to significant financial stress. Beginners should avoid investing borrowed money or following unverified social media advice. Instead, focusing on structured methods like DCA and respecting key support levels helps maintain discipline during uncertain periods.

Long-Term Outlook and Lessons From Market Corrections

Market corrections are a natural part of any financial ecosystem, including cryptocurrency. The Bitcoin price drop February 2026 explained for beginners highlights how volatility can serve as a learning opportunity rather than a setback. Experienced investors often view downturns as moments to reassess strategies, improve knowledge, and refine investment plans.

Understanding how support levels, risk management, DCA interact can help beginners build confidence over time. By focusing on education and realistic expectations, investors can navigate future price fluctuations more effectively. The key is to treat market drops as part of a larger cycle rather than a permanent trend.

Conclusion: Staying Calm and Strategic During Bitcoin Volatility

The recent market movement demonstrates why education and planning are essential in cryptocurrency investing. The discussion around Bitcoin price drop February 2026 explained for beginners shows that understanding core concepts like support levels, risk management, DCA can make a significant difference in how investors respond to volatility. Instead of reacting emotionally, beginners should focus on long-term goals, disciplined strategies, and continuous learning.

While price drops can feel alarming, they also provide opportunities to reassess strategies and strengthen financial habits. By staying informed and maintaining a balanced approach, investors can navigate market cycles with greater confidence and clarity.

FAQs

What caused the Bitcoin price drop February 2026 explained for beginners?

The drop is linked to market sentiment, macroeconomic factors, and breaking key support levels.

What are support levels in crypto trading?

Support levels are price zones where buying interest may prevent further declines.

Is DCA a good strategy during a market dip?

Yes, DCA helps spread investment risk and avoids trying to time the market perfectly.

How important is risk management for beginners?

Risk management is essential because it helps limit losses during volatile periods.

Should beginners sell during a price drop?

Not necessarily. Understanding Bitcoin price drop February 2026 explained for beginners helps investors make calm, informed decisions instead of reacting emotionally.