UAN activation steps in 2026 are no longer a beginner nuisance. They are a financial survival requirement. And most Indian employees still don’t realize that an inactive or broken UAN quietly blocks PF withdrawals, employer transfers, pension credits, and even some job-change onboarding processes.

Here is the uncomfortable truth: if your UAN login is not activated and verified properly, your PF money is basically trapped inside EPFO’s system.

This UAN activation steps guide explains how EPFO login creation actually works, why OTP errors are exploding, how to reset your UAN password without getting locked out, how to update your mobile and email correctly, and how to fix silent failures that are making millions of salaried Indians think the portal is “down” when it is actually rejecting their data. No fluff. Just compliance reality.

Why UAN Activation Became Critical in 2026

UAN is no longer just a tracking number.

It is now a master PF identity.

Your UAN controls:

-

PF balance access

-

Online withdrawal eligibility

-

Employer transfer approvals

-

Pension credits

-

KYC verification

If your UAN is inactive or broken, none of this works.

What UAN Activation Actually Means

This is misunderstood badly.

UAN activation is not just “creating a login.”

It includes:

-

Mobile number linking

-

Aadhaar seeding

-

KYC verification

-

Login credential creation

If any of these fail, your UAN is technically alive but functionally useless.

Who Must Activate UAN in 2026

This is not optional.

UAN activation is mandatory for:

-

All salaried employees

-

Anyone who wants PF withdrawal

-

Anyone changing jobs

-

Anyone merging PF accounts

If your employer generated a UAN and you never activated it, you are already behind.

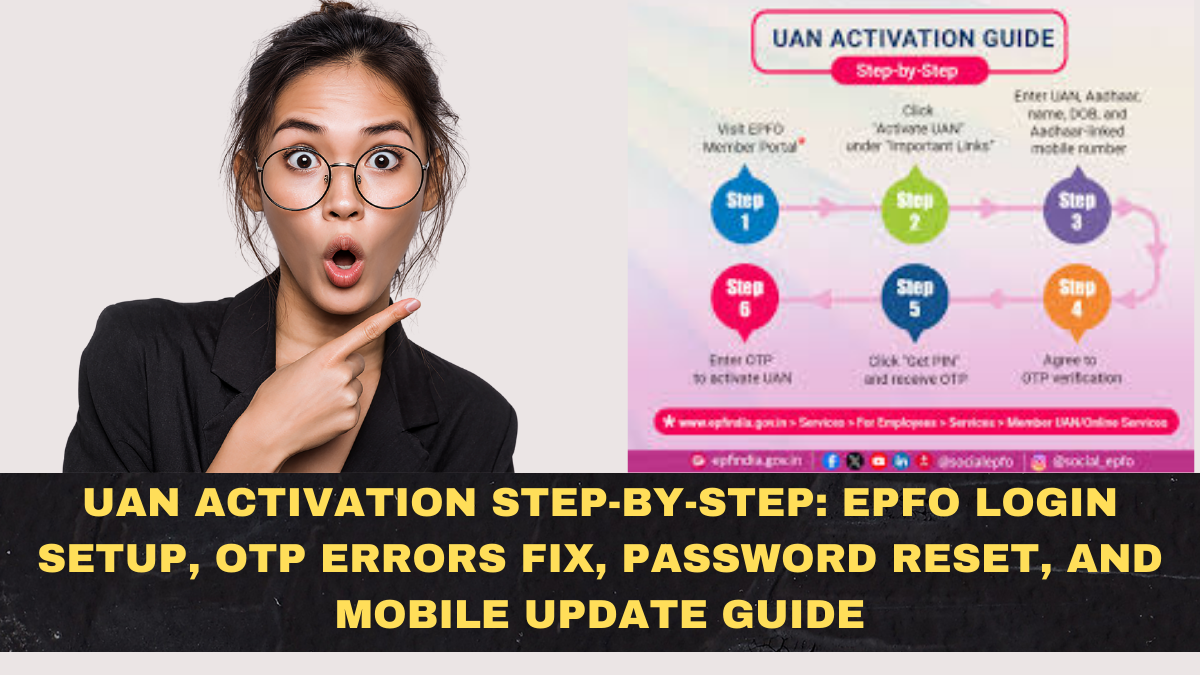

How UAN Activation Actually Works

This looks simple.

It isn’t.

Backend flow:

-

Enter UAN on EPFO portal

-

Enter Aadhaar or PAN

-

Receive OTP on Aadhaar-linked mobile

-

Verify OTP

-

Create password

-

Login created

-

KYC verification triggered

One failure breaks the chain.

Why OTP Errors Are Exploding in 2026

This is the biggest pain point.

OTP failures happen because:

-

Mobile not linked to Aadhaar

-

Aadhaar mobile outdated

-

Name mismatch in Aadhaar

-

UIDAI server delays

-

Telecom delivery failures

Most people blame EPFO.

The real culprit is Aadhaar data mismatch.

The Correct Fix Order for OTP Failures

This saves weeks.

Do this in order:

-

Check mobile linked to Aadhaar

-

Update Aadhaar mobile if wrong

-

Fix name mismatch in Aadhaar

-

Retry UAN activation

Retrying blindly never works.

How to Reset UAN Password Without Getting Locked Out

This is where people panic.

Correct flow:

-

Go to EPFO login page

-

Click “Forgot password”

-

Enter UAN

-

Verify OTP

-

Set new password

If OTP doesn’t arrive, your Aadhaar mobile is wrong.

Why UAN Password Resets Fail Silently

This is cruel.

Common reasons:

-

Wrong date of birth in EPFO records

-

Name mismatch

-

Aadhaar not seeded

The portal doesn’t explain this clearly.

It just rejects.

How to Update Mobile Number in EPFO Correctly

This is misunderstood badly.

You cannot update mobile directly in EPFO unless Aadhaar is verified.

Correct method:

-

Update mobile in Aadhaar first

-

Then seed Aadhaar in EPFO

-

Then update mobile in EPFO profile

Reverse order fails.

How to Update Email ID in EPFO

This one is easier.

Once logged in:

-

Go to profile

-

Edit contact details

-

Verify OTP

-

Save

Email is used for alerts.

Not for authentication.

Why KYC Verification Is Now Mandatory for PF Withdrawal

This is where people get blocked.

Without KYC:

-

Online withdrawal fails

-

Employer approval becomes mandatory

-

Claim gets rejected

Mandatory KYC includes:

-

Aadhaar

-

PAN

-

Bank account

All three must be verified.

Why Bank KYC Is the Biggest Claim Rejection Trigger

This hurts people.

Common bank KYC failures:

-

Name mismatch

-

Wrong IFSC

-

Inactive account

-

Joint account issues

PF refunds go into black holes because of this.

How Long UAN Activation Actually Takes

Ignore optimistic promises.

Realistic timelines:

-

Best case: 5–10 minutes

-

OTP failure case: 1–7 days

-

Aadhaar correction case: weeks

Most delays are data-related.

What To Do If Your UAN Is Already Active but Login Fails

This confuses people.

Correct response:

-

Reset password

-

Verify Aadhaar seeding

-

Check DOB and name

-

Retry login

Do not create a second UAN.

That creates legal chaos.

Why Creating Multiple UANs Is Financial Suicide

This is serious.

Multiple UANs cause:

-

PF fragmentation

-

Transfer delays

-

Pension credit loss

-

Withdrawal blocks

Always merge UANs.

Never create a new one.

Why UAN Activation Feels Hostile in 2026

Because the system assumes:

-

You might be lying

-

Your identity might be fake

-

Your mobile might be stolen

So it blocks first and verifies later.

This is fraud containment.

Not bad UX.

The One Thing Every Salaried Indian Must Do Now

Before you need PF money:

-

Activate UAN

-

Seed Aadhaar

-

Verify KYC

-

Fix mismatches

Doing this during a financial emergency is hell.

Conclusion: UAN Activation Is Now Financial Hygiene, Not Optional Paperwork

UAN activation steps in 2026 are not technical trivia.

They are financial hygiene.

If your UAN login works perfectly and your KYC is verified, your PF money is yours.

If your data is messy, your PF money is hostage.

Stop postponing UAN activation.

You are delaying your own financial freedom.

FAQs

Is UAN activation mandatory in 2026?

Yes. UAN activation is required for PF withdrawals, transfers, and online services.

Why am I not receiving OTP during UAN activation?

Because your Aadhaar-linked mobile is outdated or your Aadhaar data mismatches EPFO records.

How can I reset my UAN password?

Use the “Forgot password” option on the EPFO portal and verify OTP.

Can I update my mobile number in EPFO directly?

Only after Aadhaar is seeded and verified in EPFO.

What happens if I have multiple UANs?

You must merge them. Multiple UANs cause PF transfer and withdrawal failures.

Click here to know more.